how to claim working from home tax relief

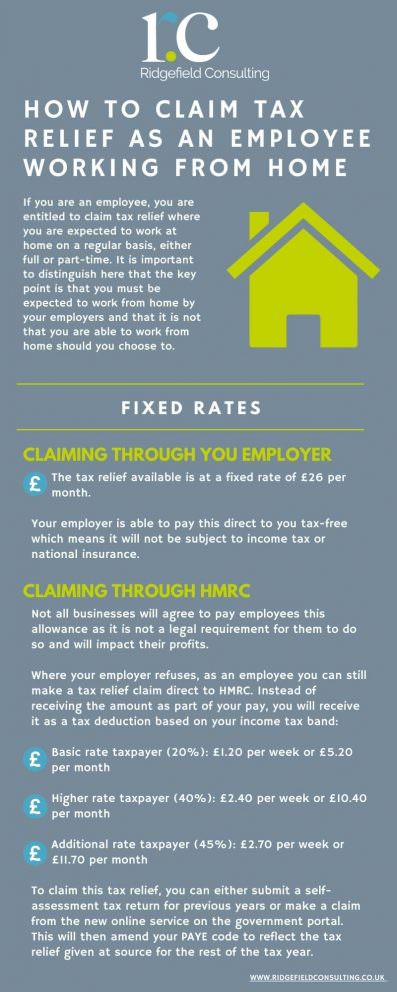

Any statute of limitations relating to claiming prior year income tax refunds or credits that. Workers who pay basic-rate income tax can claim 120 a week in tax relief 20pc of 6 towards the cost of their household bills.

Working From Home Tax Relief How To Claim Tax Relief

Individual and dependent relatives.

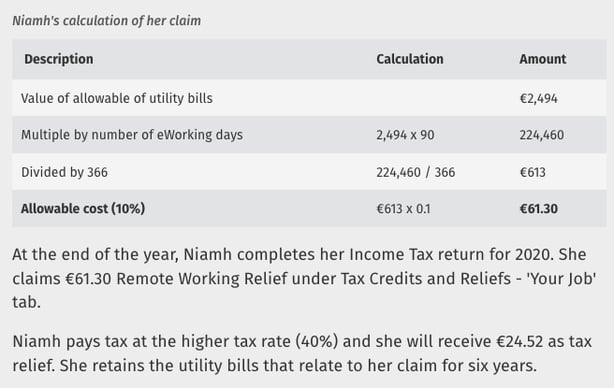

. Remote working relief allows people to claim tax relief of 10 of the cost of electricity and heating and 30 of the cost of broadband apportioned over the number of days you worked from home. Any individual whose annual net income is not more than Rs5 Lakh is eligible to claim tax rebate under Section 87a of the Income Tax Act 1961. Certificate of Residence COR.

In this way the deduction will be Rs2000. Furthermore it deals with. Heres a more detailed look at the fine print behind each income tax relief you can claim in 2020 for YA 2019.

Performance of his or her duties while working from home. The amount of private residence relief you can claim or. It specifically relates to the income tax treatment of e- workers sometimes referred to as remote workers for the purpose of claiming income tax relief for expenses incurred by the individual during periods of working from homeremote working.

Coronavirus Tax Relief FAQs Coronavirus Tax Relief FAQs Corona Virus Tax Relief FAQs. Does the relief extend the statute of limitations to file a refund or to claim certain credits for a prior year income tax return for example a 2016 return that was originally due on April 15 2017. If DTA applies check the Claim for relief under Avoidance of Double Taxation Agreement DTA and indicate the applicable tax rate when filing.

Once their application has been approved the online portal will adjust their tax code for the 2021. This manual contains guidance on e-working. Claim tax on your BMA subscription As a BMA member you may be eligible to claim tax back from your BMA subscription.

Granted automatically to an individual for themselves and their dependents. Employees who have either returned to working in an office since early April or are preparing for their return can still claim the working from. Medical treatment special needs and carer expenses for parents.

Includes care and treatment by a nursing home and non-cosmetic. If DTA does not apply withhold tax at the prevailing tax rate file and make payment to IRAS by the due date. The amount of letting relief you can claim will be the lowest of either.

The gain you receive from the letting proportion of the home or. The income tax rebate under Section 87a offers some relief to the taxpayers who fall under the tax slab of 10. Tax relief for locum doctors As a locum doctor you may work via an agency or the NHS or you may decide to operate through a limited company.

T he COVID-19 pandemic has led to many people in the United Kingdom having to work from home either on a short-term basis or permanently and that could lead to you having some tax relief. For 2020-21 tax returns lettings relief was only available for people who were in shared occupancy with their tenanttenants. To claim for tax relief for working from home employees can apply directly via GOVUK for free.

Read the guidance and advice about tax relief for locum doctors. This means an individual can get a rebate on tax of up to Rs2 000. Tax relief is based on the rate at which you pay tax so if you pay the 20 per cent basic rate of tax and claim tax relief on 6 a week you would get.

Obtain supporting document from the non-resident.

Different Ways To Claim Tax Relief When Working From Home

You Can Now Claim For The Entire Years Work At Home Allowance Before The End Of The Tax Year R Ukpersonalfinance

Explainer How To Claim Work From Home Tax Relief

How Do You Claim Working From Home Tax Relief Bluespot Furniture Direct

Hmrc Over 1 Million People Have Already Claimed If You Re Working From Home Because Of Covid 19 You May Be Able To Claim Tax Relief It S Quick And Easy To Do On

Martin Lewis Working From Home Due To Coronavirus Even For A Day Claim Two Years Worth Of Tax Relief

How To Claim Working From Home Tax Relief Be Clever With Your Cash

0 Response to "how to claim working from home tax relief"

Post a Comment